The Results of Transaction Analysis in Debits-equal-credits Format.

1 While this may be confusing at first and it may be tempting to simply use positive and negative numbers to. The results of transaction analysis in debits-equal-credits format.

The Accounting Equation Learn Accounting Bookkeeping Business Accounting Basics

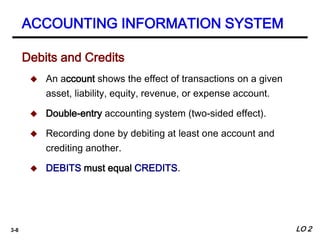

The double-entry system for determining the equality of the accounting equation is much more efficient than the.

. The trial balance must have all aggregated debits and credits equal. R-E-L-I-C Revenues Equity and Liabilities are Increased with Credits. The journal entry is a method for expressing the effects of a transaction on accounts in a debits-equal-credits format.

The primary report used by accountants is the trial balance. The results of transaction analysis in debits- equal-credits format. The result of transaction analysis in accounting format.

The reason for this seeming reversal of the use of debits and credits is caused by the underlying accounting equation upon which the entire structure of accounting transactions are built which is. The title of the account s to be debited is are listed first and the title of the account s to be credited is are listed underneath the debited accounts. The title of the accounts to be debited is are listed first.

Types of subsidiary journals include aged accounts receivable aged accounts payable cash disbursements and fixed assets accumulated depreciation. Summary Credit and debit entries are the cornerstones of the double-entry system which requires every business transaction to be recorded in at least two accounts. Indicate the effects of each days transactions in a debits-equal-credits format.

Analyzing Transactions Step 2. The following example shows a sample journal. Do the following events result in a recordable transaction for Half Price Books.

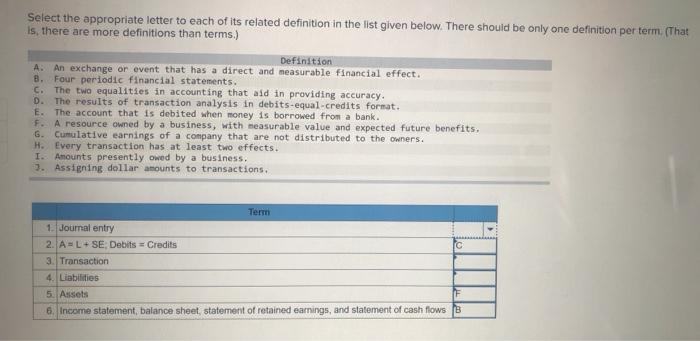

The results of transaction analysis in debits-equal-credits format. The results of transaction analysis in debits-equal-credits format. A resource owned by a business with measurable value and expected future benefits.

A date is included for each transaction. The results of transaction analysis in debits-equal-credits format _____ 5. Debit and credit form the backbone of the double-entry system where every transaction comprises two parts for every debit transaction there is a corresponding credit of an equal amount.

Repeat Steps 1 through 4 for the OTHER account in this transaction. It is the job of the bookkeeper to make sure that it is in balance and that there are no abnormal values within the respective types. Recording journal entries using debitcredit format Step 3.

Summarizing in Ledger accountsjournal entries do not provide account balances so that is what the ledger accounts is for T-accounts are a simplified ledger. Cumulative earnings of a company that are not distributed to the owners. The order of the.

A resource owned by a business with measurable value and expected future benefits. In the check window choose the COGS account from the Expenses tab or choose an Item from the Items tab that is associated with the COGS account. These accounts normally carry a credit balance.

Every transaction has at least two effects. A simplified version of a ledger account used for summarizing the effects of journal entries. The account that is debited when money is borrowed from a bank.

A debit decreases the balance and a credit increases the balance. Generate subsidiary journals and a general journal. The journal entry is a method for expressing the effects of a transaction on accounts in a debits equal credits format.

A L SE. The account that is debited when money is borrowed from a bank. Each transaction is recorded using a format called a journal entry.

A journal shows all the transactions. If every transaction is recorded with equal debits and credits then the sum of all the debits to the accounts must equal the sum of all the credits. Credits increase liabilities revenues and equity while debits result in decreases.

These are the events that carry a monetary impact on the financial system. Debit and Credit are the two accounting tools. Assets Debit increases it Credit decreases it Liabilities Debit decreases it Credit increases it Stockholders Equity Debit decreases it Credit increases it PROFIT LOSS AC Expense Revenue Gain Dividend Expense Loss- Debit increases it Credit decreases it Revenue Debit decreases it Credit increases it Income Gain Debit decreases it.

Record accounting transactions in the accounting system using double-entry bookkeeping with balancing debits and credits. Indicate the effects of each days transactions in a debits-equal-credits format. When you write the check QuickBooks will automatically credit Cash.

Business transactions are to be recorded and hence two accounts which are debit and credit get facilitated. Assets Liabilities Equity. Every transaction has at least two effects.

The title of the accounts to be credited is are listed underneath the debited accounts and the account titles and amounts credited is are indented to the right. E The account that is debited when money is borrowed from a bank. First debits must ultimately equal credits.

Total debits in a journal entry transaction must equal the total credits in that transaction. While keeping an account of this transaction these accounting tools debit and credit come into play. Debit COGS increase its balance Credit Cash decrease its balance.

Cumulative earnings of a company that are not distributed to the owners. All the transactions are recorded in a journal. To aid recall rely on this mnemonic.

Income statement balance sheet statement of retained earnings and statement of cash flows. Cumulative earnings of a company that are not distributed to the owners. So a journal entry is a way to record a business transaction.

Debits Credits The two equalities in accounting that aid in providing accuracy. The results of transaction analysis in debits-equal-credits format. A resource owned by a business with measurable value and expected future benefits.

Assets normally have debit balances whereas liabilities and stockholders equity accounts normally have credit balances. The account that is debited when money is borrowed from a bank _____ 6. A list of accounts and their corresponding ending values is called a trial balance.

Every transaction has a least two effects. Debits appear first on top and credits are written below the debits and are indented to the right words amount. Either way the COGS account receives the debit.

You need at least one debit and one credit for every. We use the debit and credit rules in recording transactions. Combine your answer from Step 2 and Step 3 to find whether you DEBIT or CREDIT the account you identified in Step 1.

Accounts Debits And Credits Principlesofaccounting Com

Understanding And Using Financial Statements Ppt Download

Acc101 Chapter 2new Chapter 2 Conceptual Frame Work For Dicision Making Financial Accounting Studocu

Ch03 Financial Reporting And Accounting Standards

Understanding And Using Financial Statements Andrew Graham Queens University School Of Policy Studies Sps Ppt Download

Solved Select The Appropriate Letter To Each Of Its Related Chegg Com

Reporting Investing And Financing Results On The Balance Sheet Ppt Download

Understanding And Using Financial Statements Ppt Download

Properly Record Debits And Credits With Examples Xelplus Leila Gharani

What Is Debit And Credit Explanation Difference And Use In Accounting

Accounting Period Is The Timespan Covered In Financial Reports Accounting Cycle Accounting Trial Balance

Ch02 Test Bank For Financial Accounting Ifrs Edition 3e Chapter Studocu

Doc Rules Of Debit And Credit Debits Rules Using Debits And Credits Kaycee Evangelista Academia Edu

Bookkeeping Double Entry Debits And Credits Accountingcoach

Chapter Two Transaction Analysis Ppt Download

Bab 2 John Pdf Debits And Credits Equity Finance

Tlons Match Each Of The Statements Below With Its Proper Terms May Not Be Used Some Homeworklib

The Debit Credit Framework The Framework Used For Journals And Ledger Accounts Was Created More Than 500 Years Ago Journals Are Used To Record The Effects Ppt Download

Pdf Chapter 2 Learning Objectives 1 Describe How Accounts Debits And Credits Are Used To Record Business Transactions 2 Indicate How A Journal Is Used In The Recording Process 3 Explain How

Comments

Post a Comment